The Definitive Guide to Estate Planning Attorney

Table of ContentsEstate Planning Attorney for DummiesThe 5-Second Trick For Estate Planning AttorneyNot known Facts About Estate Planning AttorneyWhat Does Estate Planning Attorney Do?

Estate preparation is an activity strategy you can make use of to establish what takes place to your assets and responsibilities while you live and after you die. A will, on the various other hand, is a lawful record that describes how properties are distributed, who looks after children and pet dogs, and any kind of various other dreams after you die.

The administrator also has to settle any type of tax obligations and financial obligation owed by the deceased from the estate. Financial institutions normally have a restricted amount of time from the day they were notified of the testator's death to make cases versus the estate for money owed to them. Claims that are declined by the executor can be brought to justice where a probate judge will certainly have the final say as to whether the claim stands.

Indicators on Estate Planning Attorney You Should Know

After the supply of the estate has been taken, the worth of possessions computed, and taxes and debt settled, the executor will after that seek authorization from the court to distribute whatever is left of the estate to the recipients. Any type of estate tax obligations that are pending will certainly come due within nine months of the day of fatality.

Each specific areas their properties in the trust and names somebody various other than their partner as the beneficiary., to sustain grandchildrens' education.

Excitement About Estate Planning Attorney

This technique involves cold the value of an asset at its worth on the date of transfer. Appropriately, the amount of potential capital gain at death is additionally iced up, enabling the estate coordinator to approximate their possible tax obligation upon fatality and better strategy for the settlement of earnings tax obligations.

If adequate insurance policy profits are available and the plans Source are correctly structured, any revenue tax obligation on the deemed personalities of possessions adhering to the fatality of an individual can be paid without considering the sale of assets. Proceeds from life insurance policy that are received by the beneficiaries upon the fatality of the insured are usually earnings tax-free.

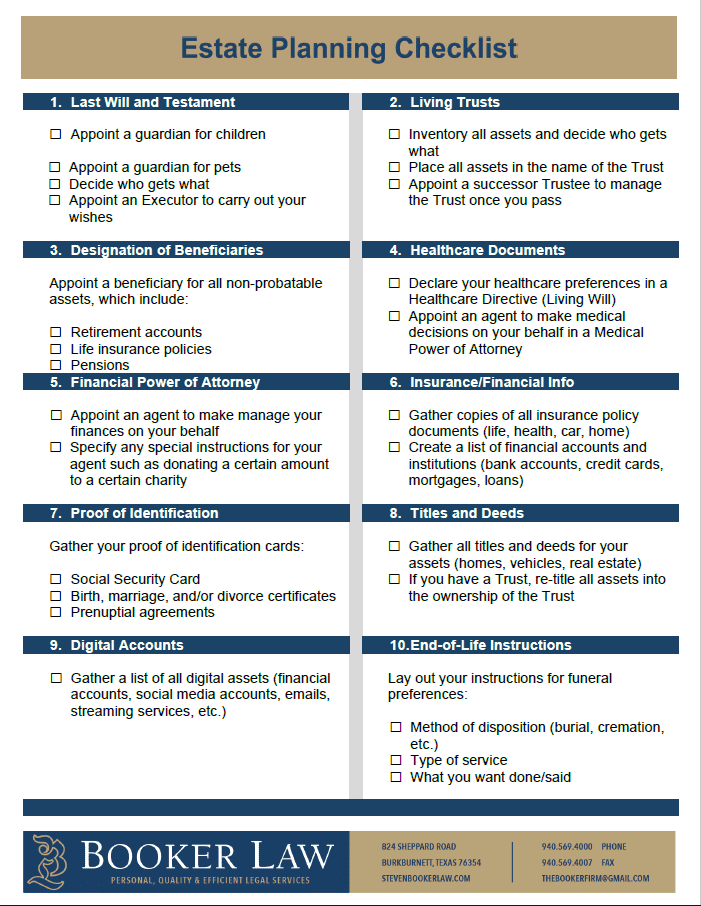

There are specific papers you'll require as part of the estate preparation procedure. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth people. Estate intending makes it less complicated for people to establish read here their desires prior to and after they die.

Everything about Estate Planning Attorney

You need to start intending for your estate as quickly as you have any quantifiable possession base. It's an ongoing procedure: as life proceeds, your estate plan should change to match your scenarios, in line with your brand-new goals. And maintain it. Refraining your estate planning can cause unnecessary financial worries to liked ones.

Estate preparation is typically taken a tool for the wealthy. However that isn't the case. It can be a valuable method for you to manage your assets and responsibilities before and after you pass away. Estate preparation that site is also a great method for you to set out strategies for the care of your minor youngsters and pets and to describe your yearn for your funeral and favored charities.

Applications must be. Qualified applicants that pass the exam will certainly be officially accredited in August. If you're eligible to rest for the exam from a previous application, you might file the brief application. According to the rules, no qualification shall last for a duration longer than 5 years. Learn when your recertification application schedules.